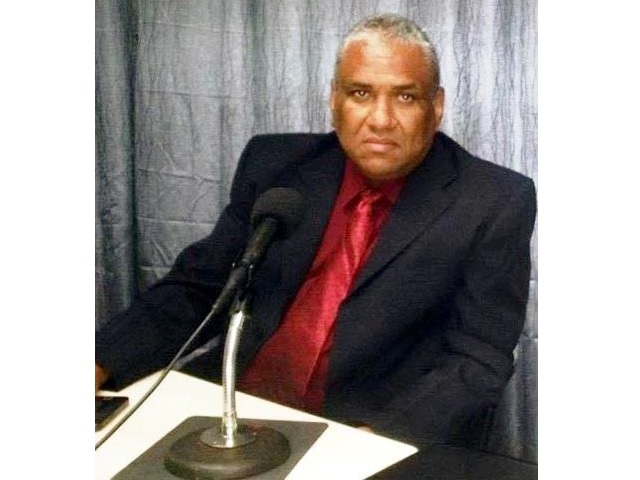

PHILIPSBURG, Sint Maarten — Certified Risk Analyst, Terence Jandroep CRA CQA CLA, recently elaborated an article on minimum earners in Sint Maarten and continues to indicate the unbalances between Minimum Earners and cost of living, starting with wage comparisons and now with residential rent comparisons.

The comparisons in residential rent between Sint Maarten Aruba and Curacao are as follows:

Rent Curacao are equal to rent in Sint Maarten but in Antillean Guilders, SXM rent $800, Curacao rent Naf. 800,= meaning an average of 80% compared to Curacao.

Rent Aruba is approx. 40% more expensive than Curacao, meaning Sint Maarten rent is 28.6% higher than Aruba, while the minimum wage earner in Aruba has Naf. 305,= more spending power.

This condition puts the minimum earner of Sint Maarten in a monthly financial catastrophe of having 12.4% to 20.4 %less spending power than their Dutch Caribbean peers with a rent burden of 28.6%-80% rental burden, creating an impoverishment trigger to the highest level. The questions that come to mind is how do they survive, and who is more vulnerable during island elections or Is this condition maintained deliberately. The other question that comes to mind is how do we make it happen for the minimum earners without impacting the inflation thus without increasing the salaries that trigger a domino effect.

1st Solution from a Risk Analyst perspective:

In the year 2020, the Tax system abolished a calculation that should be implemented and reclassified in another manner. The formula to calculate Rent value was as follows:

Cost of Housing Unit x 60% x 8%=rental value in figures for example $100.000 x60% x 8%= Rental value of $4,800 per year or $400 per month, which is now charged $750,=. This condition requires everyone that leases to have the value of their property appraised and apply this calculation to determine the REAL residential rent value levels and overcharged values. The usage of Social class Zoning will determine the value of the properties for most accurate valuations.

2nd Solution:

A second solution is comprised in the using the tax break to the benefit of the tenants:

Currently the lessor can deduct 35% of the rental income from immoveable assets, meaning from every $1000 he is allowed to declare $ 650,= for tax purposes. If this tax bracket is applied and reclassified directly to the tenant, the lessor will pay as he earns, while giving the tenant a 35% break on his rental burden, creating a financial buffer for the minimum earners in Sint Maarten without invoking the inflation indicators..

The Certified Risk Analyst graduated in Colombia is of the opinion that is disturbing that no one in Government in the last decade ever came with a practical solution to the rooted problem emphasizing the urgent need for Risk Analysts to create a sustainable economy. By creating a financial buffer the minimum earner will have additional participation of 30% to the economic traffic in Sint Maarten by relieving the financial burden and creating more purchase power that will reflect in the Government TOT income.

Any organization that wishes to discuss the matter can contact: tjandroep@gmail.com